FREQUENTLY ASKED QUESTIONS (FAQs) ON LIBERALISATION OF THE MOTOR TARIFF

1. What is a motor insurance tariff?

Tariffs are sets of fixed price list created under insurance acts to streamline and control premium charges and policy wordings.

Examples of these are Motor and Fire insurance policies. When premiums are tariffed, insurance companies are not allowed to vary the prices chargeable on the insurance policy.

2. What does the liberalisation of motor insurance mean?

Consumers will now be able to enjoy a wider choice of motor insurance products at competitive prices as liberalisation encourages innovation and competition among insurers and takaful operators.

Insurers and takaful operators are able to charge premiums that are in line with broader risk factors inherent in a group of policyholders being insured; and also market new products that are not defined under the tariff.

3. Who was controlling the tariff rate?

As the supervisory authority for all financial institutions, Bank Negara Malaysia (BNM) has the oversight on the application of Tariffs.

4. How was insurance premium calculated before 1 July 2017?

Insurance premium is calculated based on the sum insured and model of the vehicle. Additionally, insurers are allowed to apply limited premium loading based on the age of the driver and the number of accidents on record. Depending on the driver’s claims history, the calculated premium to be paid is adjusted against the discount (No Claim Discount or NCD).

Typically, drivers with good driving records can enjoy a higher percentage of NCD up to 55%.

However, the driver may experience receiving different quotes from different insurers due to other factors mentioned above.

5. If the old system worked well, why change it?

As Malaysia progresses towards a developed nation status, the insurance market is being opened up to allow a more equitable approach to the charging of premium.

A good risk should be rewarded and a bad risk recognised. This means that a good driver should pay lesser premium compared to another driver who is in a class that is more likely to experience many accidents. There should also be incentives for perceived bad drivers to become better risks and be rewarded with reduction in premium.

6. When will the Liberalisation of Motor Tariffs be implemented?

The first phase of the Liberalisation of the Motor and Fire Tariff was introduced on 1 July 2016. During this initial phase, insurers and takaful operators were given the flexibility to offer new motor products and add-on covers that were not defined under the existing tariff.

From 1 July 2017 onwards, premium rates for Motor Comprehensive; and Motor Third Party Fire and Theft products will be liberalised where premium pricing will be determined by individual insurers and takaful operators.

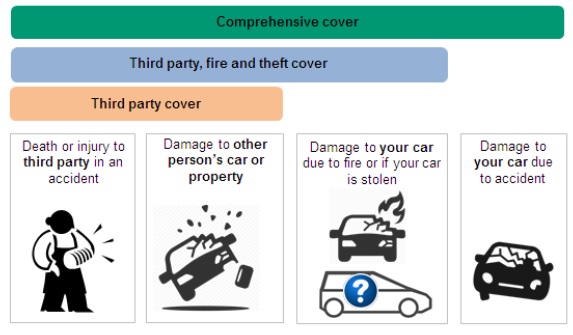

However, premium rates for Motor Third Party product will continue to be subjected to tariff rates. The existing motor products and coverage are:

7. Has Liberalisation been implemented in other countries, what is the outcomes there?

Liberalisation and open markets are associated with developed countries. The journey can be guided or left to market forces.

8. What are the benefits of the Liberalisation of the Motor Tariffs?

For consumers, the benefits include:

- An improvement in the quality of service and a wider range of products at competitive prices due to greater competition among insurers.

- The availability of new products with different features that will enable consumers and businesses to obtain the coverage that best meets their insurance needs.

- As safety features will be one of the factors to determine premiums, drivers will be incentivised to inculcate safe driving habits which will benefit them and the general public.

- Competitive pricing will be offered by insurers and takaful operators where consumers may benefit from shopping around to obtain the best deals that suit their needs.

- New distribution channels such as cost efficient online channels would enable insurance protection to be purchased in a manner most convenient to consumers.

9. How is the Liberalisation advantageous to me? How do I benefit?

As a consumer, there is an expectation that there will be wider choices and options of motor and fire products available to purchase, and that the products will be more suited to the individual’s needs.

For low risk groups, premiums are expected to be lower. On the other hand, for high risk groups, premiums chargeable are expected to be higher but this can be moderated by risk reduction factors undertaken by the policyholders e.g. safer driving habits to reduce accidents, installation of car telematics or certified anti-theft devices for cars which help reduce theft.

10. What are the new features available based on market pricing? How will insurance premiums be priced from 1 July 2017 onwards?

Effective 1 July 2017, under the liberalised environment, more risk factors will be taken into account in determining premiums. Other than the sum insured, cubic capacity of the vehicle engine, age of vehicle and age of driver, premiums may be driven by other factors.

These factors could be safety and security features of the vehicle, duration that the vehicle is on the road, geographical location of the vehicle (in areas with higher incidents of theft) and traffic offences on record. These factors will define the risk profile group of the policyholder which will determine the premium.

As different insurers and takaful operators have different ways of defining the risk profile group, the price of a motor policy would differ from one insurer to another.

11. What should consumers look out for when purchasing the motor insurance in this new environment?

Consumers should consider the following points when buying insurance:

- You should not be looking at pricing as the only factor when purchasing motor insurance protection plan. You should also look for what the policy covers, exclusions and customer service standards.

- You should shop around by contacting the agents, insurers or takaful operators through their call-centres or online channels for enquiries and advice to obtain the right kind of coverage that meets your insurance protection needs at a price acceptable to you.

- Please ensure comparative shopping is done early before your insurance policy expires. Your insurer or takaful operator will advise you at least a month earlier before the expiry of your motor insurance policy.

12. If I am a safe/good driver without any traffic summonses and reported accidents, will my premium be lowered?

Driving behaviour and driving experience is expected to be considered in risk profiling in order to determine the premium.

13. Will the No Claim Discount (NCD) still be maintained after Liberalisation?

The NCD structure will remain unchanged and continue to be transferable from one insurer or takaful operator to another. You will be entitled to the NCD which you are eligible for.

14. Will the Motor Third Party insurance product be available for consumers?

Motor Third Party insurance product is still available for consumers who want to purchase basic motor insurance cover at tariff rate.

15. Where can I obtain information of new products available and how do I choose products that will meet my needs?

You are advised to always check with your insurer or takaful operator or the agent on new products and add-on covers introduced.

Do shop around to make informed purchasing decisions by obtaining different quotations by contacting the agents, insurers or takaful operators through their call-centres or online channels.

16. What % increase can I expect on my motor premium?

This will differ from insurer to insurer. Consumers should shop around for the motor insurance that best meets their needs.

17. For consumers, getting the new motor premiums will be time consuming?

New online distribution channels which are cost efficient would enable insurance protection to be purchased in a manner most convenient to the consumers.

We anticipate that there will be developments in IT online platforms that will be able to provide consumers a quick comparison of prices with different features enabling them to make an informed decision.

18. How are insurance companies preparing for the Liberalisation?

Insurance companies in Malaysia are closely regulated by the BNM and have adequate measures and guidelines in place to ensure proper and prudent underwriting and a sound marketplace. One of the policy intentions of BNM is to moderate the increase in competition and product innovation to ensure the industry and consumers will be able to adapt in a sustainable and gradual manner.

Moreover, the Phased liberalisation is a continuation of the New Motor Cover Framework. The discussion on Phased Liberalisation between the industry and BNM has taken place since 2013. Various measures have been taken at individual company level with lead times provided to allow all insurers to build internal capabilities and formulate their marketing activities based on their business models. In addition, the Liberalisation of the Motor and Fire Tariffs will be implemented in a phased approach, which will allow time for industry to adjust to the new operating environment.

However, in anticipation of adverse unsustainable pricing, the regulator has phased the liberalisation process and insurance companies will need to get approvals if they want to price aggressively. In addition, the Risk Based Capital Framework will ensure companies have adequate funds in place.

19. Market knowledge about insurance is very low in Malaysia. How will this Liberalisation help Malaysians make informed decisions?

Although consumers will be more empowered, they can still consult their insurance agent with whom they have been consulting previously to answer all their concerns on insurance. They can also approach the companies directly and then make their own decision on the policy/cover they want to purchase.

New products to be offered will be determined by market forces. Insurers are now allowed to be more innovative and deliver better products to protect the consumers. Therefore we can expect to see some interesting products in the market. The industry has been working very closely with the regulator on the preparations for liberalisation and this new transition has been well planned under the direction of BNM.

20. What is a risk profile? Who determines a risk profile?

A risk profile is an analysis of whether a pool of consumers present a high or low risk, based on certain factors. Each insurance company is expected to be guided by its own identified risk factors.

21. Why will different insurance companies have different premiums rates? On what basis will it be calculated?

With liberalisation, there will no longer be fixed premium rates based on the model, age and cubic capacity of the vehicle to be insured.

Premiums will now be charged based on the risk profile of the insured, e.g. driving habits, claims history, etc. With this subjective assessment, there is bound to be a difference in premiums amongst insurance companies.

Consumers should shop around and select the insurance coverage that best meet their needs and at a competitive price.

22. Motorcyclists have the highest casualty rates in Malaysia, how will Motor Premiums Liberalisation affect them?

Premiums will be impacted by the claims history and driving habits of the insured. However, the first phase of liberalisation covers Comprehensive and Third Party Fire and Theft cover, which are basically purchased by owners of private cars and other four wheeled vehicles.

PIAM is committed to promote safe driving habits and all road users should consciously practice good driving habits, not just to enjoy lower premiums but also for their own safety.

23. In the event of a dispute or doubt, where does the consumer turn to?

Topical information will be posted on insurers and takaful associations’ respective websites.

In addition, consumers may contact the following:

Persatuan Insurans Am Malaysia (PIAM)

www.piam.org.my

pic@piam.org.my

Tel: 03-2274 7399

Malaysian Takaful Association (MTA)

www.malaysiantakaful.com.my

mtasecretariat@malaysiantakaful.com.my

Tel: 03-2031 8160